By Guido Schulz – CEO, Necto

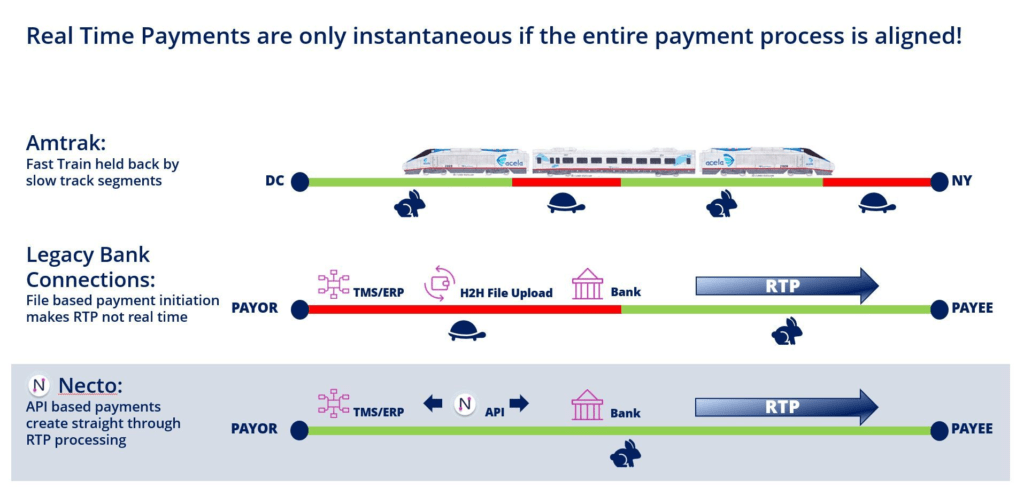

As I have been taking the Amtrak Acela train between Washington DC and New York quite frequently over the last few weeks, I couldn’t help but notice how America’s “fast” train is a fitting analogy to our current payments landscape.

Pushed and pulled by powerful Alstom engines, the hardware itself is capable of cruising at close to 200mph.

In the end, however the entire journey is only marginally faster than the slow regional trains also sharing the route.

What gives?

It’s the rails. The train only benefits from designated track for relatively short segments. The lion’s share of the journey travels on shared infrastructure, also frequented by freight and regional trains, thus forcing the train to amble along at much more pedestrian speeds.

The same holds true for the now ubiquitous real-time payment schemes.

Most corporate payments are still executed via platforms that are connected to banks on legacy rails. Files are uploaded and downloaded to and from servers via host to host connections and eventually initiated via a batch process within the bank.

While the payment itself happens in real time, the initiation rails it travels on are anything but, thus negating the entire RTP value proposition.

Necto lays the rails that allow the RTP train to travel at full speed from payor to payee. Our aggregated premium banking APIs directly connect to a bank’s core, allowing for instantaneous payment initiation and validation.

We provide the “payments Acela” with the designated fast and secure rails it deserves.

hashtag#api hashtag#paymentsinnovation hashtag#treasurymanagement hashtag#paymentrails hashtag#connectivity hashtag#payments

Categories

- API Aggregator (2)

- Cash Management APIs (1)

- News & Media (3)

- Payments APIs (3)

- Premium APIs (1)

- Press Release (1)

- Treasury APIs (3)